As a Medicare beneficiary, you may be aware of the various costs associated with the program, including monthly premiums, deductibles, and copayments. However, you may not be familiar with the Income-Related Monthly Adjustment Amount (IRMAA). This blog will explain what IRMAA is and how it can affect your Medicare costs.

What is IRMAA?

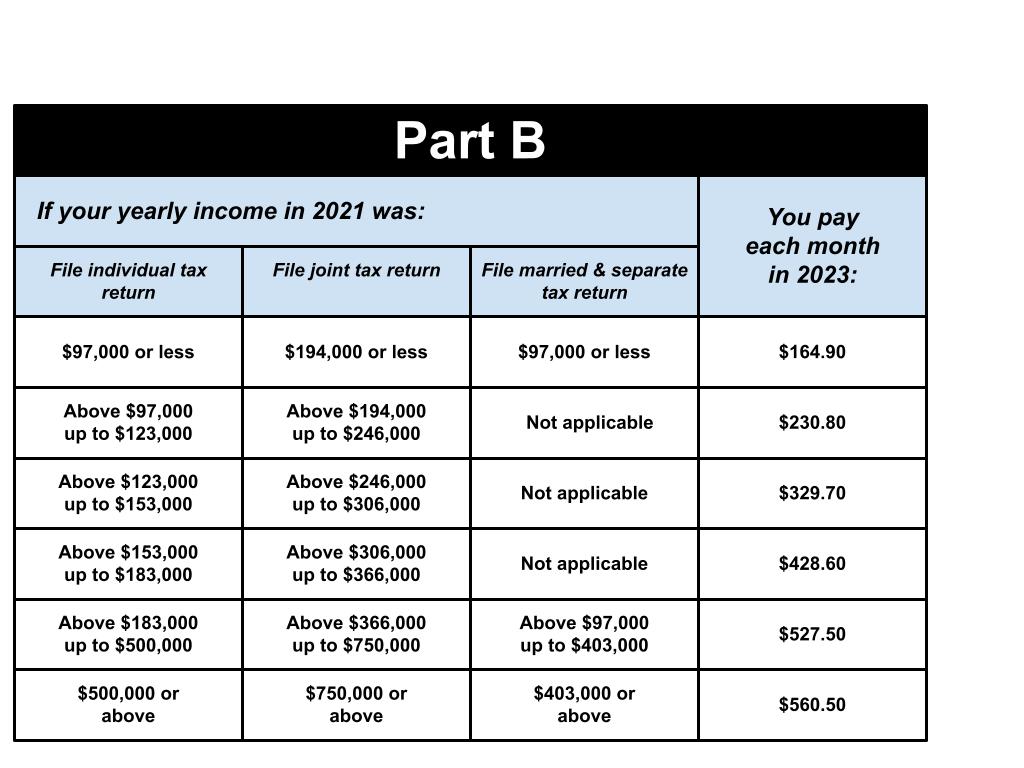

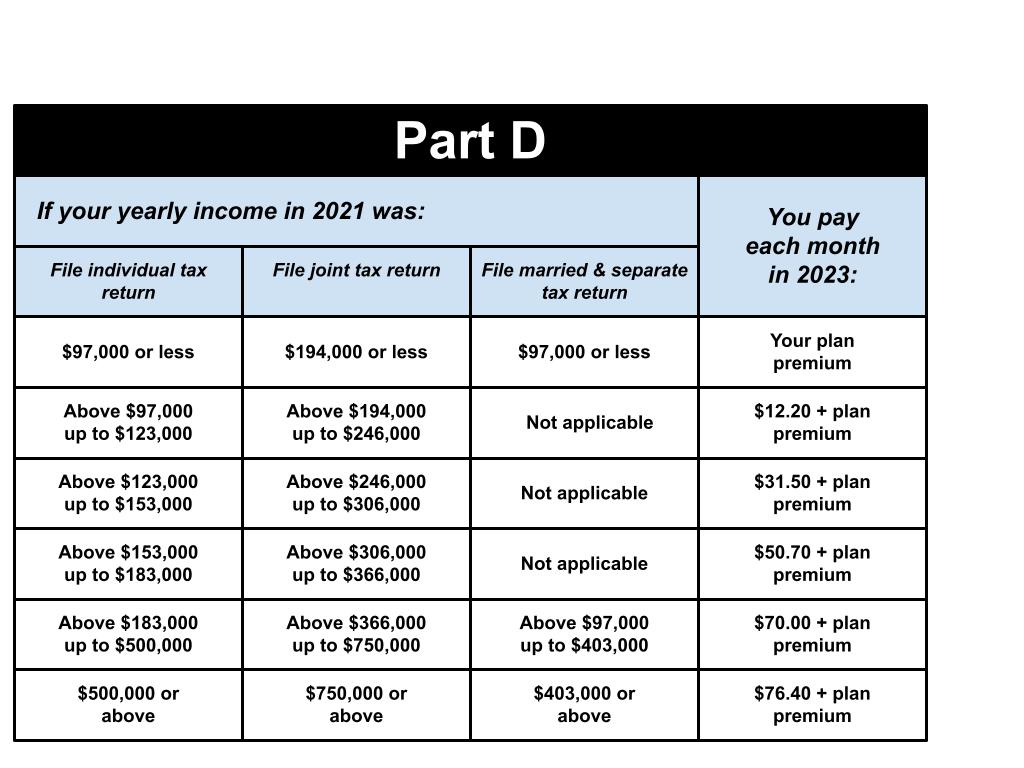

IRMAA is an additional premium amount that certain Medicare beneficiaries are required to pay based on their income. The Centers for Medicare & Medicaid Services (CMS) uses your tax return from two years prior to determine your income-related monthly adjustment amount. For example, your 2023 Medicare premiums will be based on your 2021 tax return.

IRMAA applies to Medicare Part B (which covers doctor visits and other outpatient services) and Medicare Part D (which covers prescription drugs). The amount of the IRMAA is added to your monthly premium for Part B and/or Part D, and the total amount is deducted from your Social Security benefits or billed to you directly if you do not receive Social Security benefits.

Who Pays IRMAA?

IRMAA applies to beneficiaries with a modified adjusted gross income (MAGI) above a certain threshold. For individuals, the threshold is $97,000, and for married couples filing jointly, the threshold is $194,000. If your income falls above these thresholds, you may be subject to IRMAA.

The chart below shows the 2023 IRMAA amounts for Part B and Part D based on income:

How to Pay IRMAA

If you’re subject to IRMAA, you’ll receive a notice from Social Security explaining the additional premium amount and how to pay it. You can pay the premium directly to Medicare or deduct it from your Social Security benefits.

Want to Learn More?

If you’re curious about how IRMAA works and if you will be subject to pay, reach out to Secure Insurance Group today! Our Medicare experts will happily get you the answers you’re looking for.