Get In Touch

- Toll Free: 1-877-871-7328

- Office: 417-883-9300

-

Mon-Thu: 9 AM - 5 PM

Fri: 9 AM - 1 PM

Medicare Supplement Articles

Medicare Supplements

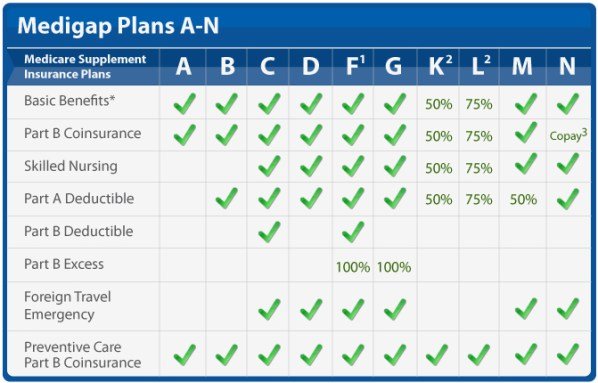

While the costs for each Medigap plan will differ among insurance companies, the coverage of each plan will remain the same.

As you shop for a Medigap policy, be sure you’re comparing the same Medigap policy (for example, compare Plan A from one company with Plan A from another company).

In some states, you may be able to buy another type of Medigap policy called Medicare SELECT (a Medigap policy that requires you to use specific hospitals and, in some cases, specific doctors to get full coverage). If you buy a Medicare SELECT policy, you also have rights to change your mind within 12 months and switch to a standard Medigap policy.

More About Medigap Policies

- You must have Part A and Part B.

- You pay a monthly premium for your Medigap policy in addition to your monthly Part B premium.

- A Medigap policy only covers one person. Spouses must buy separate policies.

- The best time to buy a Medigap policy is during the 6-month period that begins on the first day of the month in which you’re 65 or older and enrolled in Part B. (Some states have additional open enrollment periods.) After this enrollment period, your option to buy a Medigap policy may be limited and it may cost more. For example, if you turn 65 and are enrolled in Part B in June, the best time for you to buy a Medigap policy is from June to November.

- It’s important to compare Medigap policies since the costs can vary and may go up as you get older. Some states limit Medigap costs.

- If you’re under 65, you won’t have this open enrollment period until you turn 65, but state law might give you a right to buy a policy before then.

- If you have a Medigap policy and join a Medicare Advantage Plan (like an HMO or PPO), you may want to drop your Medigap policy. Your Medigap policy can’t be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums. If you want to cancel your Medigap policy, contact your insurance company. If you drop your policy to join a Medicare Advantage Plan, in most cases you won’t be able to get it back.

- If you have a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re switching back to Original Medicare. Contact your State Insurance Department if this happens to you.

Information provided by: Medicare and You Handbook 2022

Medigap Carriers

Frequently Asked Questions

What is Medicare and who can get it?

Can I change my Medicare coverage?

Yes, you can change your Medicare coverage during certain enrollment periods, such as the Annual Enrollment Period (AEP) and the Medicare Advantage Open Enrollment Period (MA OEP). Outside of these periods, you may qualify for a Special Enrollment Period (SEP) if you experience certain life events, such as moving, losing other coverage, or becoming eligible for Medicaid.

What are the different parts of Medicare?

Medicare is divided into four parts:

- Part A: Hospital Insurance

- Part B: Medical Insurance

- Part C: Medicare Advantage Plans

- Part D: Prescription Drug Coverage

Where can I get more information about Medicare?

For more information about Medicare, you can visit the official website at www.medicare.gov, contact the Medicare hotline at 1-800-MEDICARE (1-800-633-4227).

You can also give us a call and schedule a no-cost consultation where we can help you understand your options! Call us at 417-883-9300 or click “Call Now” below: