Did you know? Millions of American households recognize their need for more life insurance. The hard part is jumping through all the hoops and research to get the right coverage in place. Fortunately, Secure Insurance Group can help. Keep reading to see how much life insurance you need.

What Is Life Insurance?

A life insurance policy is a contract with an insurance company. In exchange for premium payments, the insurance company provides a lump-sum payment, known as a death benefit, to beneficiaries upon the insured’s death.

Typically, life insurance is chosen based on the needs and goals of the owner.

Note: Death benefits from all types of life insurance are usually income tax-free.

Types of Life Insurance

At Secure Insurance Group, we offer the following types of life insurance:

- Whole life

- Term life

- Guaranteed universal life

- Indexed Universal/Universal life

How Much Life Insurance Do You Need?

When we get asked this question, we typically recommend term life coverage equal to 10 times your annual income and make the policy last for 15-20 years. Some people get coverage that’s equal to 12 times their yearly income.

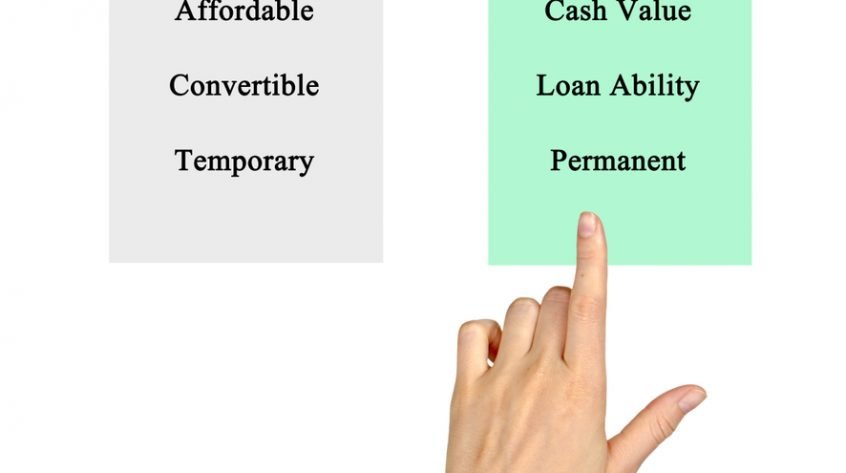

Why term life? Term life insurance is affordable, and you can pick a length of term to cover the years of your life where your loved ones depend on that income. If you pass away, your policy replaces your salary and provides a financial cushion for your family.

Also, here’s why we suggest 15-20 years on the policy term: if you have young children, they’ll be able to support themselves by the time that term ends. The only insurance they’ll need is during those 15-20 years when they’re relying on you.

What Will This Life Insurance Cover?

With life insurance coverage equal to 10 times your annual income, it replaces what you make 10 times over—for your family if you pass away. It pays the medical bills, tuition, costs for extracurricular activities, and everything else required for your dependents to make ends meet because you’re no longer around.

Example

What you can do is take your yearly salary before tax and multiply it by 10. For example, if you get $50,000 a year before tax, that would give you $500,000 in death benefit (payout) if you die.

Need More Life Insurance? Call Us

Secure Insurance Group has access to the top-rated life insurance carriers, including Foresters, Pacific Life, Nationwide, Americo, TransAmerica, and many others. Our agents have vast experience in helping people like you find the right insurance solution for their lifestyle and budget. If you think you need more life insurance, call (417) 883-9300 or get a quote online.